Ria

January 3, 2025

Understanding Financial Aid: A Guide for College Applicants

Why Understanding Financial Aid is Important

The cost of college can be daunting for many students and their families. Understanding the various types of financial aid available and how to apply for them is crucial in making higher education accessible and affordable. Navigating the financial aid process can be overwhelming for high school seniors and their parents, especially while balancing other aspects of the application, such as writing the perfect essay for applying to university. This guide aims to demystify financial aid, providing clear information and practical tips to help you maximize your financial aid package.

The Problem: Navigating Financial Aid

The financial aid process involves numerous steps, forms, and deadlines, which can be confusing and stressful. Many students and parents are unsure of what types of financial aid are available, how to apply, and what strategies to use to increase their financial aid awards. This is especially challenging while focusing on preparing a compelling essay for applying to university, which is a crucial part of the college application. Understanding the different components of financial aid and knowing how to approach the application process is essential for securing the necessary funds to attend college.

Our Take: Types of Financial Aid and How to Apply

At GoodGoblin, we are committed to helping students navigate the college application process, including financial aid. Here’s a comprehensive overview of the types of financial aid available and how to apply for them, while also balancing other application tasks like writing an effective essay for applying to university.

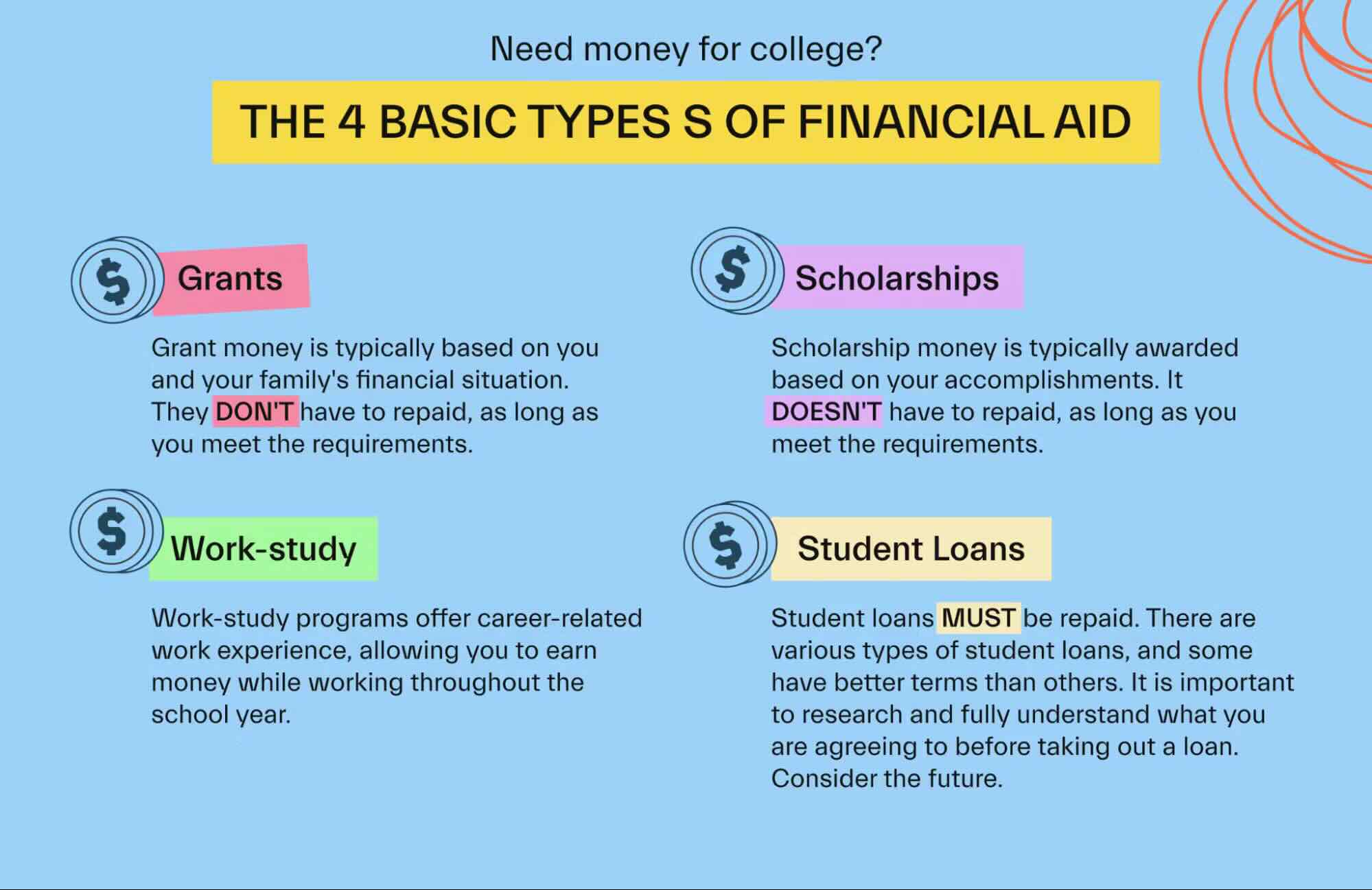

Types of Financial Aid

- Grants: Grants are typically need-based and do not need to be repaid. They are often provided by the federal government, state governments, and colleges. The most well-known federal grant is the Pell Grant.

- Scholarships: Scholarships are usually merit-based and do not need to be repaid. They can be awarded by colleges, private organizations, or community groups based on academic achievements, talents, or other criteria.

- Loans: Student loans must be repaid with interest. There are federal student loans, which often have lower interest rates and more flexible repayment options, and private student loans, provided by banks and other financial institutions.

- Work-Study Programs: Work-study programs provide part-time jobs for students with financial need, allowing them to earn money to help pay for college expenses.

How to Apply for Financial Aid

- Complete the FAFSA: The Free Application for Federal Student Aid (FAFSA) is the first step in applying for financial aid. It determines your eligibility for federal grants, loans, and work-study programs. Fill out the FAFSA as soon as possible after October 1st of your senior year, while keeping in mind deadlines for your essay for applying to university.

- Submit the CSS Profile: Some colleges require the CSS Profile, a financial aid application used by many private colleges and universities to award institutional aid. Check if your colleges require it and submit it along with the FAFSA.

- Research and Apply for Scholarships: Start researching scholarships early and keep track of deadlines. Use scholarship search engines, talk to your school counselor, and look for local scholarship opportunities. This will help ensure you have financial backing to accompany your strong essay for applying to university.

- Review Financial Aid Packages: After submitting your applications, review the financial aid packages offered by each college. Compare the types and amounts of aid offered to determine the best financial option for you.

Tips for Maximizing Your Financial Aid Package

- Apply Early: Submit your FAFSA and other financial aid applications as early as possible to increase your chances of receiving aid.

- Provide Accurate Information: Ensure all the information on your financial aid applications is accurate and complete to avoid delays or errors.

- Follow Up: If your financial situation changes or if you have special circumstances, contact the financial aid offices at your chosen colleges to discuss your situation.

- Negotiate: If your financial aid package is insufficient, you can appeal to the college’s financial aid office for additional aid. Provide documentation to support your request.

Conclusion: Partnering with GoodGoblin

Understanding and navigating financial aid is a critical part of the college application process. At GoodGoblin, we provide personalized guidance and resources to help you secure the financial aid you need, while also assisting with other critical application tasks like writing a compelling essay for applying to university. Our platform offers step-by-step instructions, tips, and real-time feedback to ensure you maximize your financial aid opportunities.

Join the thousands of students who have successfully navigated their college applications and financial aid processes with GoodGoblin. Visit GoodGoblin today and take the first step toward a financially accessible college education.

For more information on elite university admissions strategies, check out our blog Top Universities and How to Get In: Admission Tips for 2024 to enhance your overall application, including your essay for applying to university.

Trending Posts

Ready to start your college journey?

Get personalized guidance through every step of your application process

Highlights

- Career Guidance & College Matching

- Holistic App Review & Essay Feedback

- Access to Successful Reference Essays

- Comprehensive Application Management

Let us be your Copilot

Do not navigate the college application process alone

Trusted by students applying to top universities nationwide